[ad_1]

- The survey was conducted in January in the apogee of the Bitcoin historical maximum of $ 109,000.

- 59% of institutional investors plan to allocate more than 5% of assets under management to digital assets.

- An additional 75% said they intend to invest in some form of tokenization by 2026.

Institutional investors remain optimistic about cryptocurrencies, and 83 % plan to expand their exposure to them in 2025.

He study carried out by Coinbase and EY-PARTHENON and that he surveyed 352 responsible for making institutional decision making, revealed that “more than three quarters of the investors surveyed hope to increase their assignments to digital assets in 2025, and 59 % plans to assign more than 5 % of assets under management to digital assets or related products.”

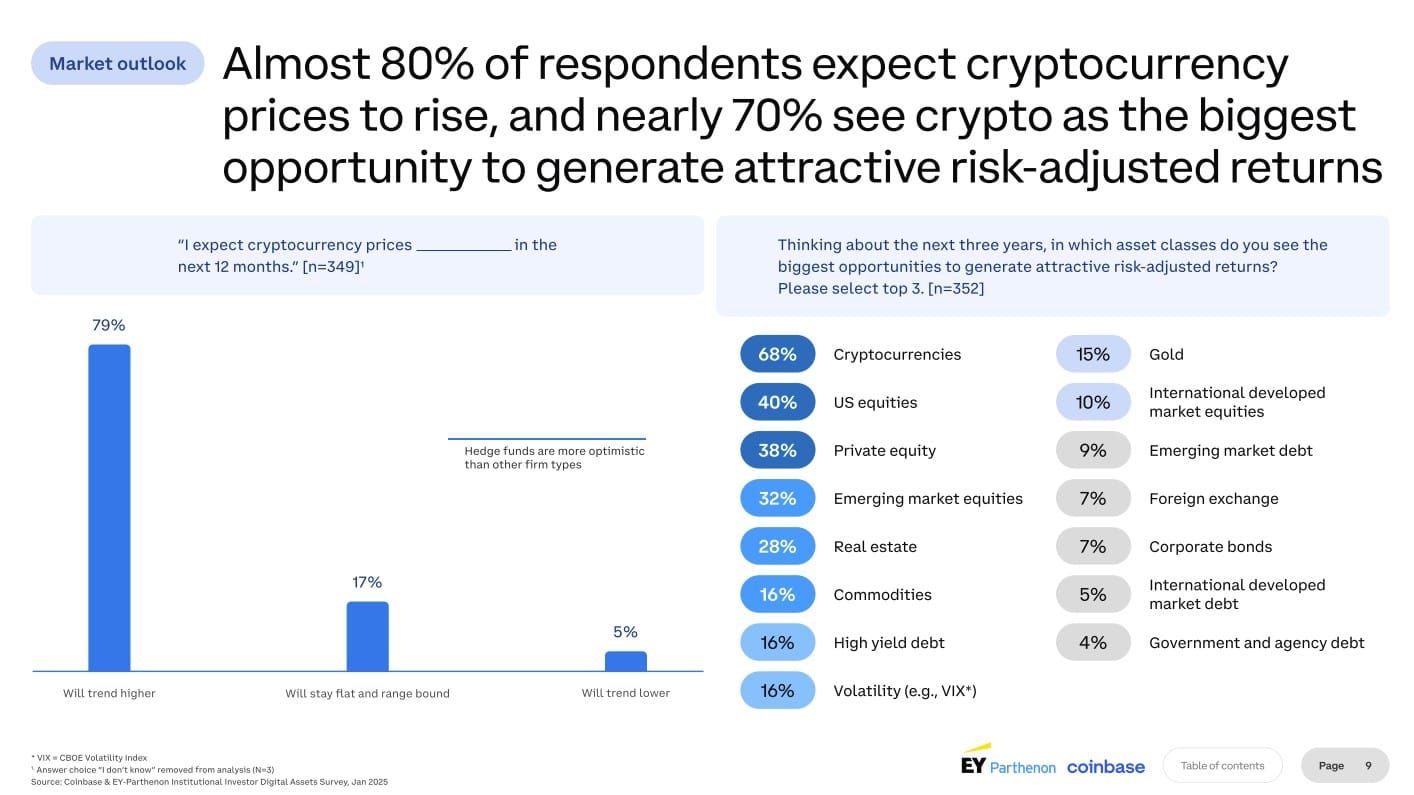

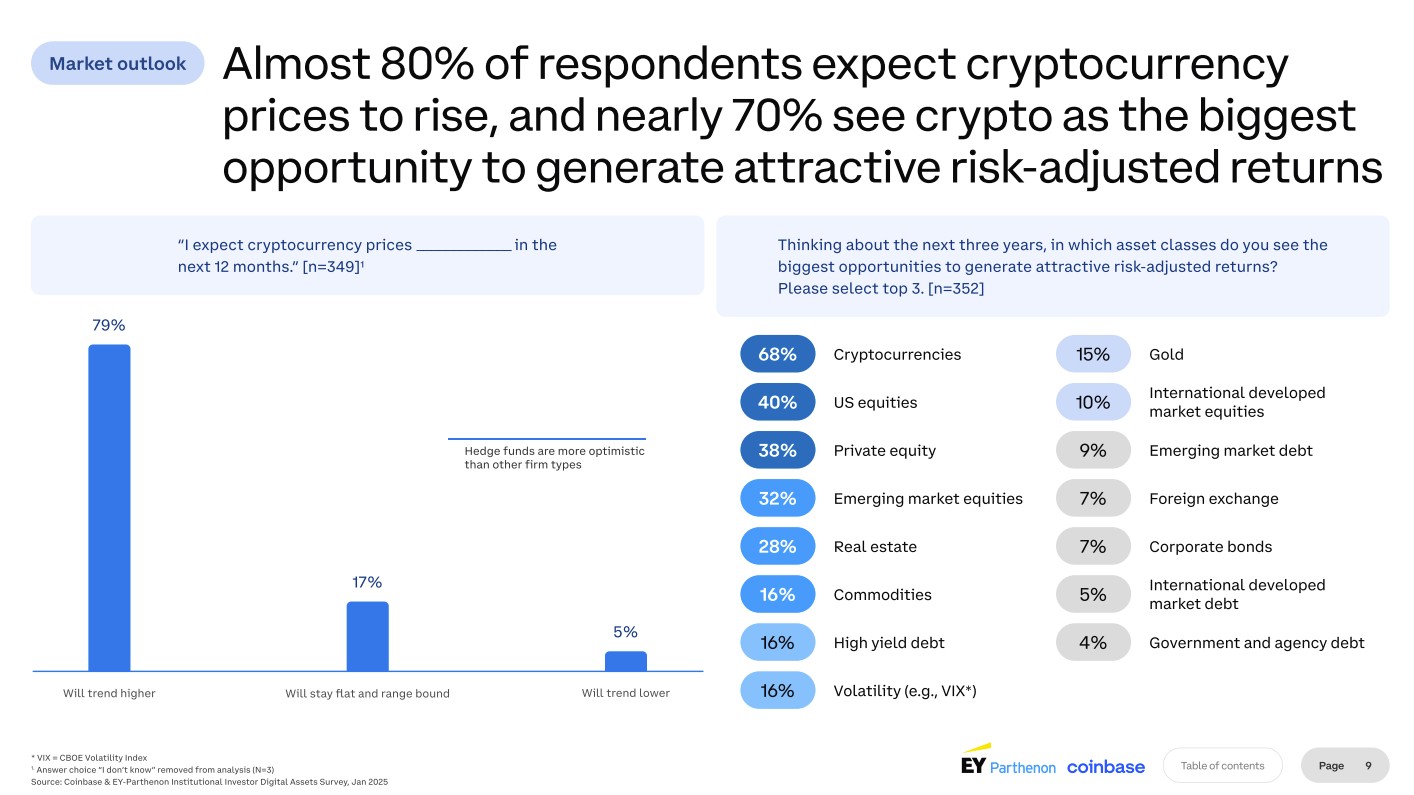

The survey, conducted at the peak of Bitcoin’s historical maximum of 109,000 $, revealed that almost 80 % of investors foresees an increase in cryptocurrency prices.

About 70 % consider that cryptocurrencies are the biggest opportunity to generate attractive risk -adjusted profitability.  Survey on digital assets of institutional investors 2025. Source: Coinbase

Survey on digital assets of institutional investors 2025. Source: Coinbase

Stable and defi coins

Interest in stable currencies is also increasing. 84 % of the institutions already use or plan to use them this year, and 75 % indicated that they intend to invest in some type of tokenization by 2026.

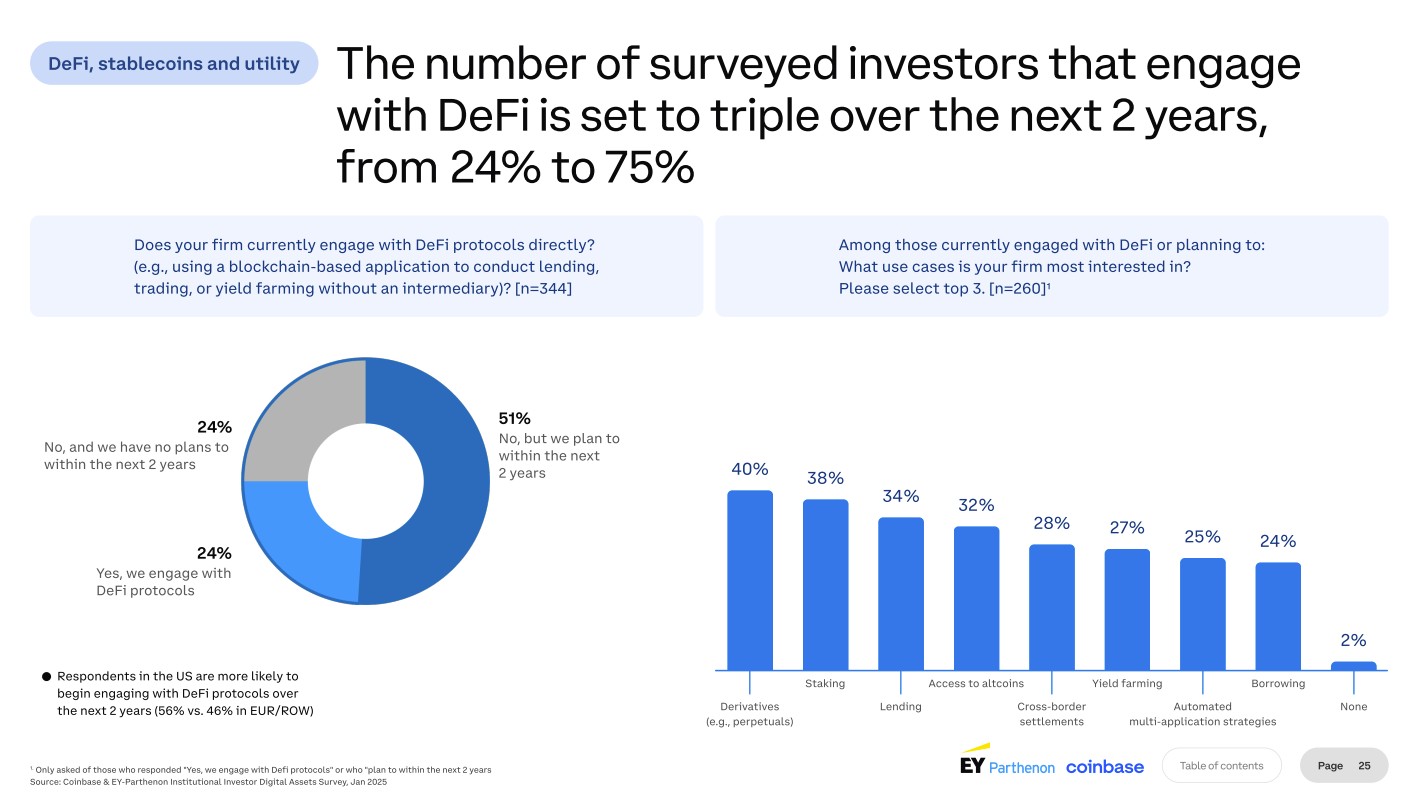

With decentralized finances (DEFI), the number of investors who participate in them will increase from 24 % to 75 % in the next two years.

However, despite the optimism that is expected to experience the sector, the barriers for the DEFI include regulatory concerns (57 %) and compliance (55 %), in addition to the lack of internal knowledge (51 %), according to the survey.  Survey on digital assets to institutional investors of 2025. Source: Coinbase .

Survey on digital assets to institutional investors of 2025. Source: Coinbase .

Among those who are currently participating in defi or planning to do so, derivatives (40%), Staking (38%) and loans (34%) are the three main cases of use that interest companies.

Contributing regulatory clarity

Institutional investors consider regulation as the greatest opportunity and the greatest risk to the cryptocurrency market in 2025.

According to the survey, greater regulatory clarity around custody, tax treatment and the use of stable currencies should attract new participants to the market and increase the activity.

“We hope that the tone and positive measures, both of the new US administration and the worldwide regulatory agencies, promote the growing interest in digital assets,” said the survey researchers.

Since the survey, cryptocurrency prices have decreased. At the time of the publication, Bitcoin quoted around $ 83,000.

Earlier this month, Bitcoin fell to $ 76,000 after US President Donald Trump did not rule out a possible recession.

The post coinbase survey: 83% of institutional investors plan to expand their exposure to cryptocurrencies in 2025 Appeared First on coinjournal.

[ad_2]

https%3A%2F%2Fcoinjournal.net%2Fes%2Fnoticias%2Fencuesta-de-coinbase-el-83-de-los-inversores-institucionales-planean-expandir-su-exposicion-a-las-criptomonedas-en-2025%2F