[ad_1]

- The price of Ethereum (ETH) is showing recovery after falling to a minimum of $ 1,415.

- The bullish patterns and the strength of Dex indicate a possible rebound in the price of ETH.

- The next tong update can lead ETH to $ 2,140.

Ethereum (ETH), the second largest cryptocurrency for market capitalization, has crossed a difficult quarter, with a price that recently fell to $ 1,415, which reflects a pronounced 61% drop from its maximum of December.

This significant fall has positioned Ethereum as a cryptocurrency with a significantly lower than expected performance, generating restlessness between investors and analysts.

However, after reaching a minimum of $ 1,415, the price has shown recovery signals, reaching around $ 1,623.42, which suggests a possible change in trend.

What caused the price of ETH to fall so low?

The drop in the price of Ethereum is partly due to internal problems. David Hoffman, co -founder of Bankless, criticized community leaders for alienating users and developers.

Hoffman points out hostile attitudes, how to criticize the Staking Platform Lido Finance and certain operators, which could have undermined confidence in the ecosystem.

Everyone Is Midcurving Why Eth’s Price Performance Has Sucked

Ethereum Leadership and Culture Have Alienated Users and Builders by Being Hostile To ITS OWN APP Layer.

We publicly exorcised @Lidofinance. We’ve Shunned Traders and Degens.

On A Permitionless Chain, We’ve Tried …

– David Hoffman (@trousssstate) April 12, 2025

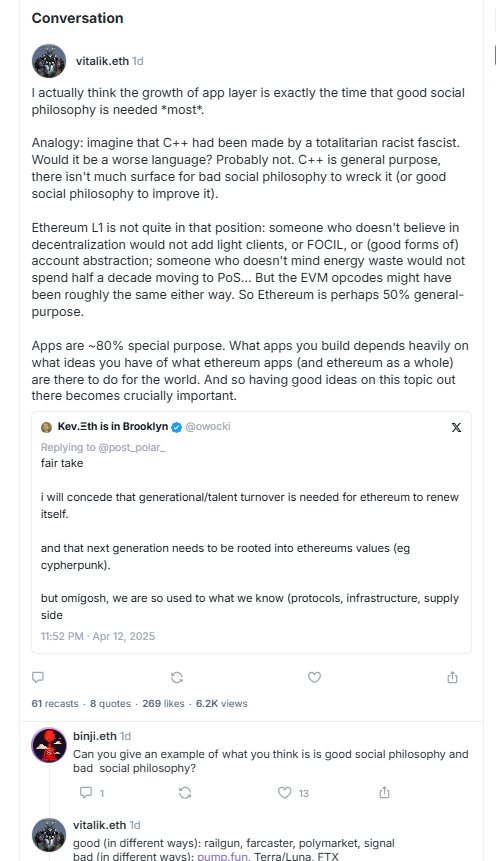

The co -founder of Ethereum, Vitalik Bugerin, In a April 12 publication on Warpcast also emphasized the need for a solid social philosophy in the Ethereum application layer to guide developers in the creation of decentralized applications that align with their fundamental values, citing projects such as Railgun and Farcuter as positive examples.

Beyond internal conflicts, Ethereum layer 1 infrastructure has had difficulty following the rhythm of new block chains, which has increased pressure on its assessment.

External factors, such as market volatility caused by President Trump’s tariff announcements, have also promoted massive cryptocurrency sales, further ballasting Ethereum.

The technical analysis indicates a rebound in the price of Ethereum (ETH)

Despite the complicated start of 2025, several factors suggest that Ethereum could be preparing for a rebound, which offers hope to those who observe their career.

However, the technical analysis presents a more optimistic panorama, since graphic patterns indicate a possible change of course in Ethereum’s fate.

A descending wedge pattern has been observed in the daily and weekly graphics, approaching a level of confluence that usually precedes an upward break.

If this pattern is confirmed, Ethereum (ETH) could reach $ 2140, an increase of 35 % compared to its current price. An inverted head and shoulder pattern, another bullish indicator, is also being formed in the one -day chart, which reinforces the possibility of a short -term upward movement.

The RSI indicator also recently bounced from the overall zone, indicating that the Token could be in an upward trend that could last a while.

The Z score of the value to value made (MVRV) dropped to -0,832 before bouncing around 0.98 at the close of this edition, indicating that Ethereum quotes well below its historical average.

This metric implies that cryptocurrency could be a bargain for investors, which could generate purchase interest that could boost its price. Historically, this undervaluation has often preceded periods of price appreciation, which reinforces the upward perspective.

The Dex based on Ethereum overcome their rivals

Ethereum’s decentralized exchange network (Dex) continues to demonstrate resilience, which represents a new reason for optimism.

Despite the blockchains competition like Solana and Arbitrum, the Dex de Ethereum processed more than $ 17 billion in volume last week, surpassing their rivals, According to defillama data .

This sustained activity highlights Ethereum’s ability to retain users and liquidity, even with higher commissions, which reinforces its fundamental strength.

This solid performance suggests that the network remains a fundamental pillar of decentralized financial space, capable of resisting competitive pressure. Valuation metrics reinforce the argument that Ethereum is ready for a recovery, since its current price seems undervalued.

The next update of Ethereum Pin

Facing the future, the sicking update, scheduled for May 7, 2025, promises to improve the Ethereum network, which could reverse some of its recent setbacks.

This update aims to address the challenges of layer 1, improving scalability and efficiency, which could restore confidence between investors and developers.

A successful launch could serve as a catalyst, promoting the price of Ethereum upwards as the market anticipates a more competitive blockchain.

Scheduled improvements as these indicate Ethereum’s commitment to evolution, a factor that could rekindle enthusiasm.

The combination of bullish technical patterns, a solid DEX ecosystem, undersauds and the promise of the sicking update builds a solid case for recovery.

Investors would do well to be attentive to resistance levels and changes in feeling, but the evidence suggests that Ethereum could rebound after its disappointing quarter.

The post why Ethereum’s price could be uploading after a disappointing quarter Appeared First on coinjournal.

[ad_2]

https%3A%2F%2Fcoinjournal.net%2Fes%2Fnoticias%2Fpor-que-el-precio-de-ethereum-podria-estar-subiendo-despues-de-un-trimestre-decepcionante%2F