- The actions will accumulate cumulative dividends at a fixed rate of 10% each year.

- The strategy said that dividend payments will begin to be paid on June 30, 2025.

- To date, Strategy has less than 500,000 bitcoin, valued at more than 40,000 million dollars.

Strategy plans to offer five million preferential actions as standard A with perpetual conflict, $ Strf, while working on the acquisition of more bitcoin.

In a release Strategy, by Michael Saylor, said he intends to use income for general corporate purposes, including Bitcoin’s acquisition.

However, he pointed out that this is subject to market conditions and other conditions. According to the company, the shares will generate cumulative dividends at a fixed rate of 10 % per year.

Dividends will be paid as of June 30, 2025 with legally available funds for payment, according to Strategy.

Fund collection for Bitcoin

The news comes when Strategy announced earlier this month that he plans to issue and sell shares for up to $ 21 billion in his program in the market (ATM).

Through the sale of shares of its preferential action perpetual series A at 8.00%, $ Strk, Strategy said that additional capital will be used for general corporate operations, including the purchase of more bitcoin. The latest news also follow a recent purchase of Bitcoin that Strategy made in an announcement yesterday.

In a publication in X Saylor said he had acquired 130 Bitcoin for $ 10.7 million at an average price of $ 82,981 per Bitcoin.

Strategy has acquired 130 btc for ~ $ 10.7m at ~ $ 82,981 per bitcoin and has Achieved Btc Yield of 6.9% Ytd 2025. As of 3/16/2025, We Hodl 499,226 $ BTC acquired for ~ $ 33.1 Billion at ~ $ 66,360 per bitcoin. $ Mstr $ Strk https://t.co/8xRMR8vlit

– Michael Saylor⚡️ (@saylor) March 17, 2025

To date, Strategy has 499,226 bitcoin, valued at $ 40.92 billion, according to Saylortracker.com . Peter Schiff, a veteran Bitcoin opponent, said Saylor’s tweet:

“Is that all you bought?

Is that all you boought? Sems Like You Are Running Out of Fire Power.

– Peter Schiff (@peterschiff) March 17, 2025

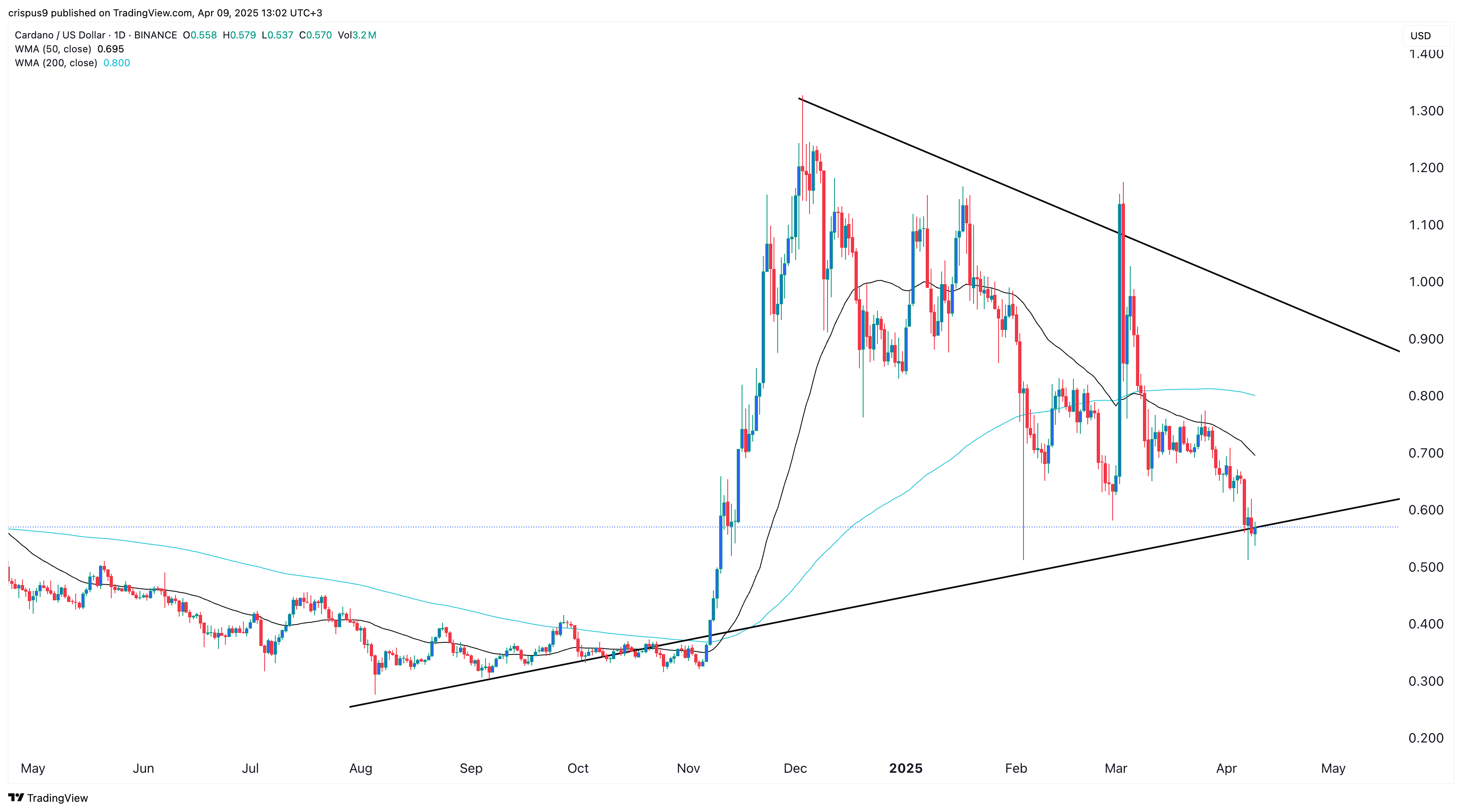

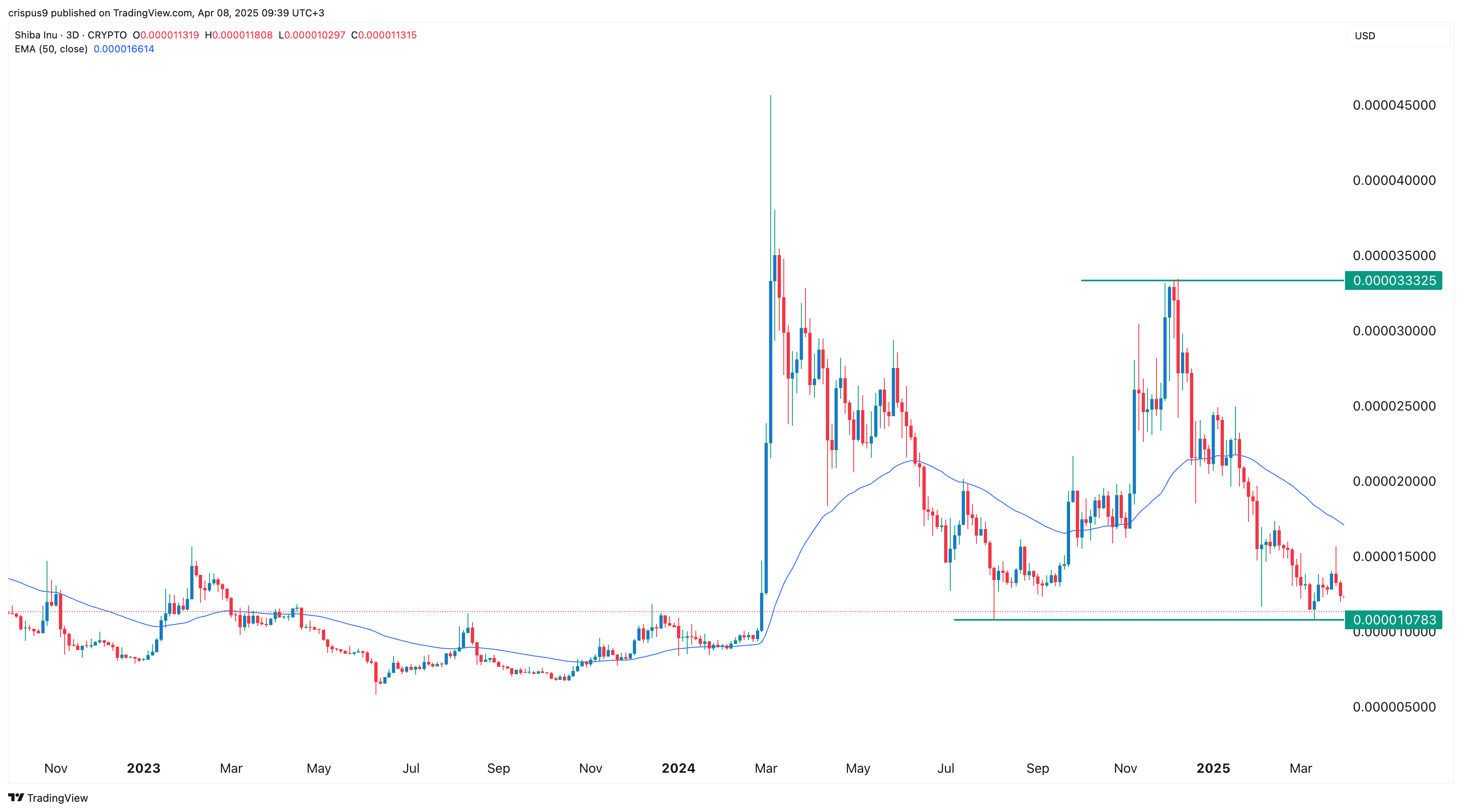

Cryptocurrency prices fall

The news of the recent purchase of Bitcoin by Strategy and its offer of shares comes at a time when cryptocurrency prices in the market have experienced a strong fall.

At the time of this publication, Bitcoin quoted around $ 81,000, a substantial fall from its historical maximum of $ 109,000 reached in January, before the investiture of US President Donald Trump.

Market conditions and geopolitical problems continue to impact prices despite the fact that Trump signed an executive order in March to create a strategic Bitcoin reserve.

https%3A%2F%2Fcoinjournal.net%2Fes%2Fnoticias%2Fla-estrategia-planea-ofrecer-cinco-millones-de-acciones-con-nuevas-acciones-preferentes-para-comprar-bitcoin-adicional%2F