[ad_1]

- Presentation of XRP futures carried out under the process of autocertification of the CFTC.

- Ripple paid $ 50 million in an agreement with the SEC last month.

- Grayscale, Franklin Templeton and others submitted requests for XRP ETF

Coinbase has taken another important step in the expansion of its supply of derivatives by requesting regulatory approval to launch an XRP futures contract. The American cryptocurrency exchange platform presented on Thursday the documentation to the Trade Commission of Futures of Raw Materials (CFTC) to autocertify the new product, with a launch date set for April 21.

This measure positions Coinbase to offer its third product of cryptocurrency futures in 2024, after the departures with Solana (Sun) and Hedera (Hbar). Unlike cash operations, future contracts allow investors to speculate on the fluctuation of the price of an asset without having the underlying token.

The incorporation of XRP could significantly improve institutional access to the currency, especially following the Ripple Partial Agreement with the United States Stock Exchange and Securities Commission (SEC) last month.

The launch of XRP futures is scheduled for April

The last presentation of Coinbase Derives before the CFTC describes the plans so that XRP futures begin to quote from April 21, waiting for regulatory authorization.

The application is made in accordance with the CFTC self -finish process, a mechanism that allows bags to streamline the inclusion of products in the market provided they comply with all applicable standards. If the agency does not oppose, the product can come into operation without delay.

The Coinbase decision of adding XRP to its line of regulated futures underlines its broader strategy to support both native cryptocurrency investors and traditional.

In recent months, the platform launched futures for Solana and Hedera, both with the approval of the CFTC by the same route. Together with XRP, Coinbase awaits regulatory approval for futures contracts linked to Cardano (ADA) and Natural Gas (NGS), whose entry into operation is planned by the end of April.

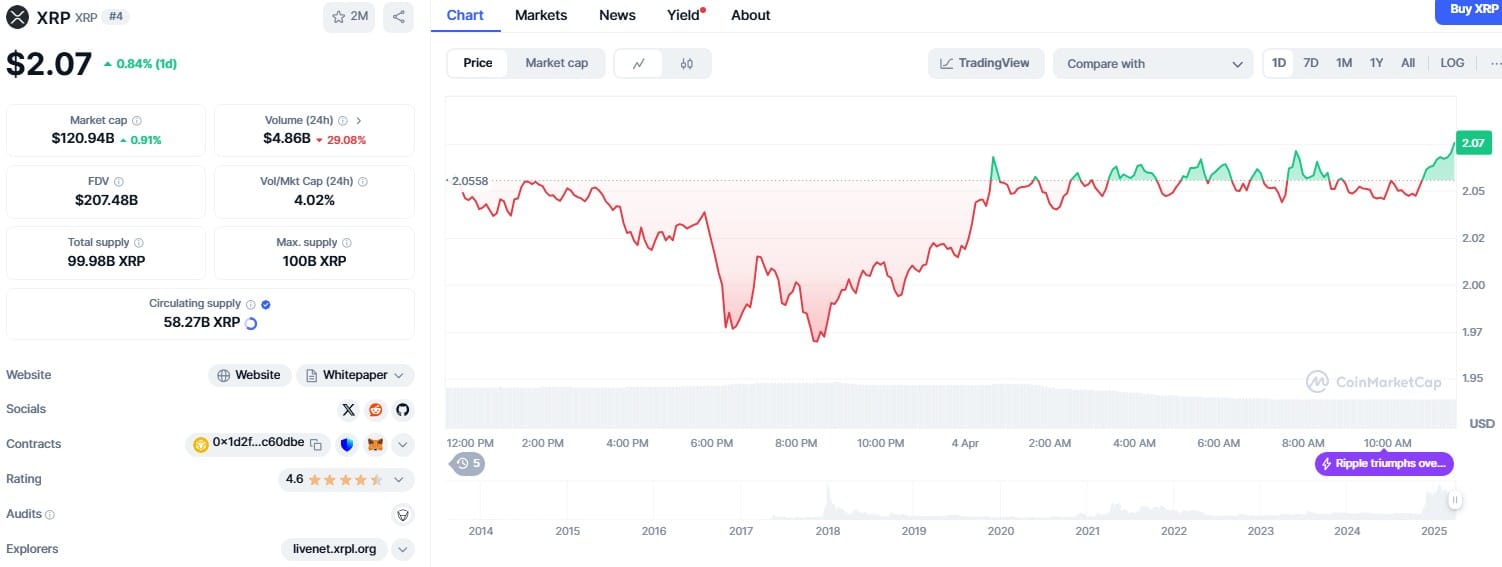

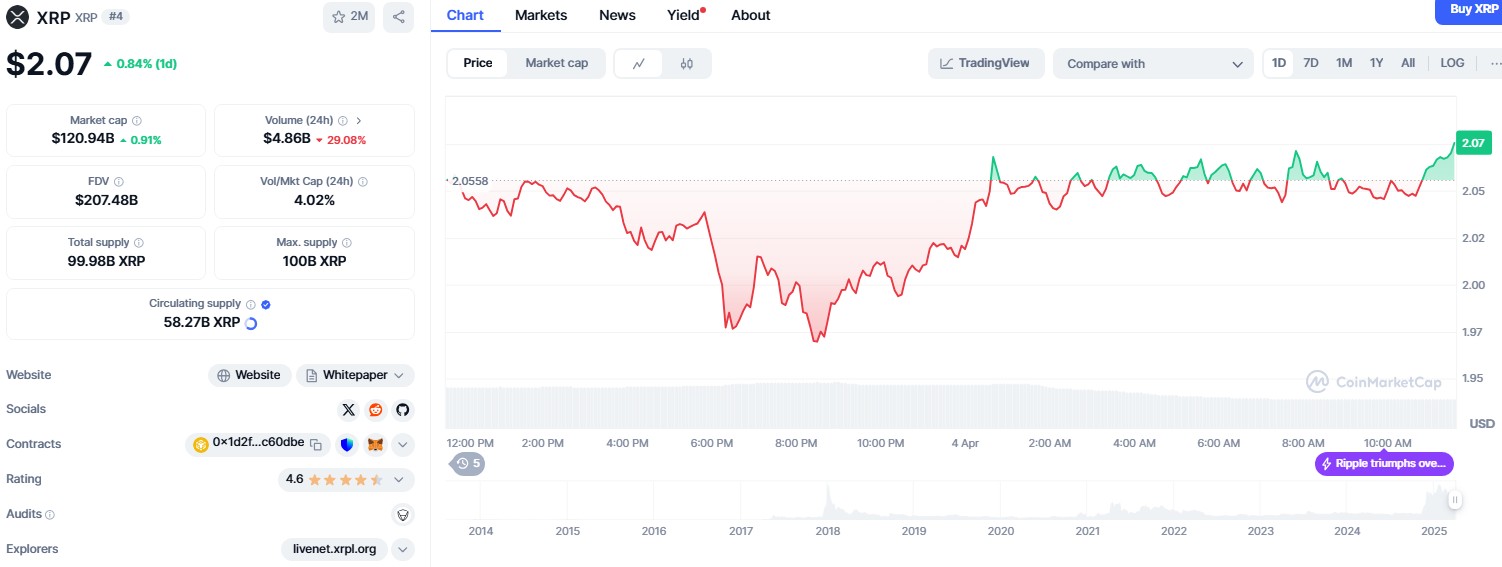

The XRP price remains stable above 2 dollars

Currently, XRP quoted slightly above $ 2 with minimal intradic volatility. The relatively stable performance of the currency contrasts with the cryptocurrency market in general, where prices have remained very reactive to macroeconomic signals and regulatory updates.

Fountain: Coinmarketcap

The main utility of XRP lies in its function as a liquidation token for rapid and economic cross -border payments. The launch of a regulated futures contract could allow investors to cover or obtain exposure to the fluctuation of the token price without having it directly.

This can be especially attractive to high frequency institutions and traders that seek to avoid custody risks associated with cryptocurrency holdings in cash.

The measure could also affect the liquidity of the market in the cash of XRP, since a greater activity of derivatives is often correlated with stronger commercial volumes and price discovery mechanisms.

Legal clarity could unlock ETFs

The Coinbase initiative on XRP futures arrives shortly after Ripple, the token creator company, resolved its prolonged legal dispute with the SEC. In March 2024, the agency withdrew its appeal in the case initiated in December 2020.

Ripple agreed to pay 50 million dollars As part of the agreement, an amount significantly lower than the 125 million originally proposed. Ripple also withdrew his counterpart, ending the dispute of several years.

The resolution has fed the speculation that the SEC could approve a bottom quoted in the XRP bag (ETF) in cash. Several important fund managers, such as Grayscale, Franklin Templeton, Bitwise, 21Shares, Coinshares, Wisdomtree and Canary Capital, have requested the approval of XRP ETFs.

Proshares and Volatility Shares also seek regulatory approval for their related investment products. Analysts believe that regulatory clarity on XRP’s legal status could pave the way for larger financial institutions, such as Blackrock and Fidelity, explore new product offers.

While the SEC has not yet issued any approval, industry participants suggest that the agreement has eliminated a key barrier to adopt XRP within the most traditional financial frameworks.

Coinbase expands cryptocurrency derivatives

The coinbase self -finish model is emerging as a proof case of how native cryptocurrency companies can operate within traditional financial regulation.

Exchange’s growing futures portfolio demonstrates how cryptocurrency companies are adapting to the supervision of the CFTC, even while the broader regulatory tensions between US agencies continue.

The CFTC has expressed interest in expanding its role in cryptocurrency derivatives markets, often facing the SEC for jurisdictional issues.

Coinbase’s ability to function in this environment could determine the speed with which the new digital asset futures products reach the market. As institutional interest grows, regulatory capacity will probably determine which platforms can compete on a large scale.

The post coinbase prepares to launch XRP futures while the expansion of derivatives Appeared First on coinjournal continues.

[ad_2]

https%3A%2F%2Fcoinjournal.net%2Fes%2Fnoticias%2Fcoinbase-se-prepara-para-lanzar-futuros-de-xrp-mientras-continua-la-expansion-de-derivados%2F